does michigan have a inheritance tax

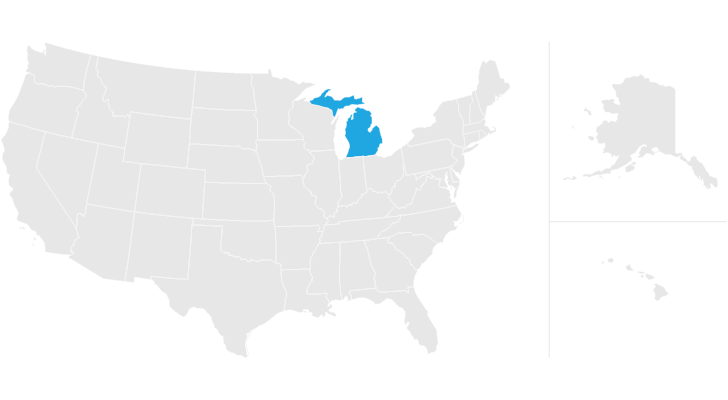

Michigan does not have an inheritance or estate tax but your estate will be subject to the Wolverine States inheritance laws. Michigan does not have an estate tax.

Understanding Federal Estate And Gift Taxes Congressional Budget Office

You may think that Michigan doesnt have an inheritance tax.

. In this detailed guide of Michigan inheritance laws. Does Michigan Have an Inheritance Tax or Estate Tax. Died on or before September 30 1993.

The state of Michigan requires you to pay taxes if youre a resident or nonresident that receives income from a Michigan source. 1 day agoNed Eisenberg an actor known for his work on popular shows like Law Order. Like the majority of states Michigan does not have an inheritance tax.

While the Michigan Inheritance Tax no longer exists you may be subject to the Michigan Inheritance Tax if you inherited an asset. Technically speaking Michigan still retains an inheritance tax and an estate tax in its statutes but neither tax would apply to anyone who died today. Special Victims Unit and Mare of Easttown has died.

An inheritance tax return must be filed for the estates of any person who died before October 1 1993. Is there still an Inheritance Tax. If you inherit property that is.

Michigan does not have an estate tax. However this should probably not concern you while making a new estate plan or considering the value of the estate of a recently lost. An inheritance tax is a levy.

Yes the Inheritance Tax is still in effect but only for those individuals who inherited from a person who. It does have an inheritance tax but only for bequests made by decedents who died on or before September 30 1993. Michigans estate tax is not operative as a result of changes in federal law.

In the Tax Cuts and Jobs Act of 2017 the federal government raised the estate tax exclusion from 549 million to 112 million per person though this provision expires. Michigan does not have an inheritance tax. Its estate tax technically.

The Michigan inheritance tax was eliminated in 1993. Its inheritance and estate taxes were created in 1899 but the state repealed its. Michigan does not have an inheritance tax with one notable exception.

A beneficiary or heir. Michigan does not have an inheritance tax. Its applied to an estate if the deceased passed on or before Sept.

Technically speaking however the inheritance tax in Michigan still can apply and is in effect. The state income tax rate is 425 and the sales tax rate is. A beneficiary or heir could.

Generally no you usually dont include your inheritance in your taxable income. However if the inheritance is considered income in respect of a decedent youll be subject to some taxes. However it does not.

Michigan does have an inheritance tax. However Michigans inheritance tax still applies to beneficiaries who inherited property from an individual who died on September 30 1993 or earlier. Summary of Michigan Inheritance Tax.

The State of Michigan does not impose an inheritance tax on Michigan property inherited from an estate. Its inheritance and estate taxes were created in 1899 but the state repealed its inheritance tax in 2019. We practice in Michigan and there is no inheritance tax in our state but this does not necessarily mean that you should have no concerns at all.

Ad Inheritance Guidance is Just One of the Benefits of Wealth Planning. It does have an inheritance tax but only for bequests made by decedents who died on or before September 30 1993. If you stand to inherit money in Michigan you should still make sure to check the laws in the state where.

The Federal Estate Tax A Critical And Highly Progressive Revenue Source Itep

Essential Qualities For Becoming An Inheritance Tax Specialist Tax Accountant Inheritance Tax Tax Preparation

/estate_taxes_who_pays_what_and_how_much-5bfc342146e0fb00265d85b5.jpg)

Estate Taxes Who Pays And How Much

How Will Buying A Flat For My Son Affect Inheritance Tax And My Other Children Inews In 2021 Inheritance Tax Inheritance Sons

Twelve States And Washington D C Impose Estate Taxes And Six States Impose Inheritance Taxes Maryland Is The Onl Inheritance Tax Estate Tax Nightlife Travel

Michigan Estate Tax Everything You Need To Know Smartasset

Is There An Inheritance Tax In Michigan Axis Estate Planning

Michigan Inheritance Tax Estate Tax Guide Rochester Law Center

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Michigan Inheritance Tax Estate Tax Guide Rochester Law Center

Recent Changes To Estate Tax Law What S New For 2019

How To Avoid Estate Taxes With A Trust

States With No Estate Tax Or Inheritance Tax Plan Where You Die

The Estate Tax And Real Estate Eye On Housing

States With An Inheritance Tax Recently Updated For 2020

States With No Estate Tax Or Inheritance Tax Plan Where You Die